Notes to the Financial Statements- Reporting Requirements for Annual Financial Reports

Content

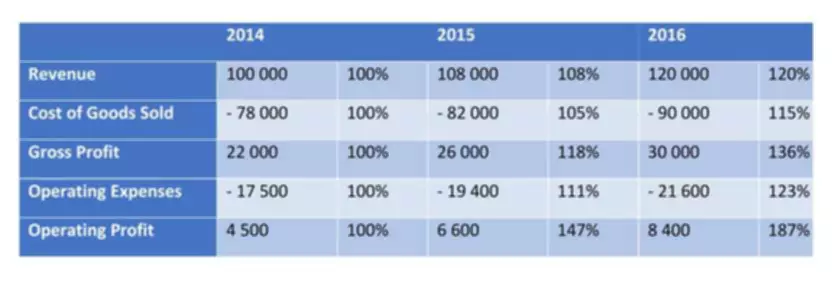

The notes to financial statements shall be highly detailed, precise, complete and easily understood by a reader who ahs a reasonable understanding of business affairs . The standard requires a complete set of financial statements to comprise a statement of financial position, a statement of profit or loss and other comprehensive income, a statement of changes in equity and a statement of cash flows. It shows the results of an entity’s operations and financial activities for the reporting period. It usually contains the results for either the past month or the past year, and may include several periods for comparison purposes. Its general structure is to begin with all revenues generated, from which the cost of goods sold is subtracted, and then all selling, general, and administrative expenses.

- It presents the matters which have been encouraged by accounting standards for transparency purpose.

- At December 31, 1999, the Company does not have significant credit risk concentrations.

- Registrants should provide disclosures required under paragraph in filings with the Commission that include financial statements of fiscal periods ending after June 15, 1997.

- The acquisition was substantially downsized from the original agreement whereby the company had, subject to certain terms and conditions, committed to purchase selected assets and businesses of Fiberite for approximately $300,000.

If increases in projected costs-to-complete are sufficient to create a loss contract, the entire estimated loss is charged to operations in the period the loss first becomes known. Provisions for losses on firm fixed priced contracts totaled $807,000, $907,000 and $1,600,000 in 1999, 1998 and 1997, respectively. As its name implies, this statement focuses on cash flows rather than income.

The Difference Between IFRS and GAAP Balance Sheet Footnote Requirements

The company periodically reviews the recoverability of all long-term assets, including the related amortization period, whenever events or changes in circumstances indicate that the carrying amount of an asset might not be recoverable. The company determines whether there has been an impairment by comparing the anticipated undiscounted future net cash flows to the related asset’s carrying value. If an asset is considered impaired, the asset is written down to fair value which is either determined based on discounted cash flows or appraised values, depending on the nature of the asset.

In addition, in 1997, the company received $8,500 of net proceeds, which approximated book value, from the sale of its Anaheim, California facility. Footnotes to the financial statements serve as a way for a company to provide additional explanations for various portions of their financial statements. Footnotes to the financial statements thus report the details and additional information that is left out of the main financial statements such as the balance sheet, income statement, and cash flow statement. Five elements of the financial statement include the balance sheet, income statement, statement of cash flow, statement of changes in equity, and the notes to the financial statements.

What Happens to Assets If the Company Pays for Notes Payable?

Shareholders’ equity is the amount owners invested in the company’s stock plus or minus the company’s earnings or losses since its inception. As discussed in Note 9, Hexcel has various financial and other relationships with CSC.

Why are financial statements important?

Financial statements are important because they can help business owners and prospective investors make better decisions on the long-range viability/strengths of a company.

Effective immediately thereafter, GroupTech was merged with and into Sypris, a subsidiary created to accomplish the reincorporation in Delaware. In connection with the Reorganization, a one-for-four reverse stock split was effected for shareholders of record as of March 30, 1998. All references in the financial statements to number of shares and per share amounts of the Company’s common stock have been retroactively restated to reflect the decreased number of shares outstanding. A balance sheet or statement of financial position, reports on a company’s assets, liabilities, and owners equity at a given point in time. As you can see, the notes to financial statements provides enormous information about how the company manages its business and the practices it follows and an analyst must use such information in his analysis. Notes to the financial statement include important factors that were used in preparing the statement.

What are Financial Statement Notes?

Recently there has been a push towards standardizing accounting rules made by the International Accounting Standards Board . IASB develops International Financial Reporting Standards that have been adopted by Australia, Canada and the European Union , are under consideration in South Africa and other countries. The United States Financial Accounting Standards Board has made a commitment to converge the U.S. Employees also need these reports in making collective bargaining agreements with the management, in the case of labor unions or for individuals in discussing their compensation, promotion and rankings. If a user or application submits more than 10 requests per second, further requests from the IP address may be limited for a brief period. Once the rate of requests has dropped below the threshold for 10 minutes, the user may resume accessing content on SEC.gov.

In most jurisdictions, public companies are required by law to publish financial statements on a quarterly/semi-annually/annually basis. A detailed discussion is made on items exhibited in the balance sheet, income https://www.bookstime.com/ statement, cash flow, and statement of changing capital. However, not being a good steward over the P&L and cash flow statements would be the equivalent of a diabetic never monitoring their glucose levels.

Subsequent events are events that happen after the date the financial statements are created but before the financial statements have been issued to the public. A contingent liability is a liability that has not occurred, but the conditions are favorable for the event to occur in the immediate future. The line items in the balance sheet, income statement, statement of changes in equity, and cash flow contain a reference for the numbering in the notes to the financial statement. It enables the user to get a more detailed understanding and breakup for the specific movement of the account balance/transaction. The accompanying consolidated notes to financial statements financial statements include the accounts of Hexcel Corporation and subsidiaries (“Hexcel” or the “company”), after elimination of intercompany transactions and accounts. The company develops, manufactures and markets lightweight, high-performance reinforcement products, composite materials and engineered products for use in the commercial aerospace, space and defense, electronics, general industrial and recreation markets. The company serves international markets through manufacturing and marketing facilities located in the United States and Europe, as well as sales offices in Asia, Australia and South America.

- The section contains a description of the year gone by and some of the key factors that influenced the business of the company in that year, as well as a fair and unbiased overview of the company’s past, present, and future.

- An allocation of profit or loss and comprehensive income for the period between non-controlling interests and owners of the parent.

- Describe the most significant restrictions on the payment of dividends by the registrant, indicating their sources, their pertinent provisions, and the amount of retained earnings or net income restricted or free of restrictions.

- In addition to the Senior Credit Facility, certain of Hexcel’s European subsidiaries have access to limited credit and overdraft facilities provided by various local lenders.

Repairs and maintenance are charged to expense as incurred; replacements and betterments are capitalized. Property, plant and equipment are depreciated over estimated useful lives, using accelerated and straight-line methods.

Understand what notes to financial statements include, learn the importance of disclosure notes, and see examples. This is done mainly for the sake of clarity because these notes can be quite long, and if they were included in the main text they would cloud the data reported in the financial statement. Using footnotes allows the general flow of a document to remain appropriate by providing a way for the reader to access additional information if they feel it is necessary. It allows an easily accessible place for complex definitions or calculations to be explained should a reader desire additional information. The accounting policies section provides information on the accounting policies adopted by management in preparing the financial statements. Disclosing the accounting policies helps users interpret and understand the financial statements better.

MASS MEGAWATTS WIND POWER INC Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-Q) – Marketscreener.com

MASS MEGAWATTS WIND POWER INC Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-Q).

Posted: Fri, 02 Dec 2022 21:29:07 GMT [source]